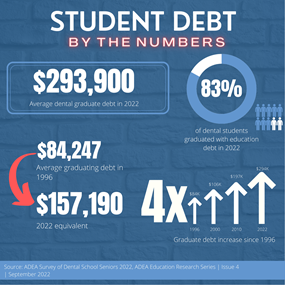

The average debt per graduating senior in 2022 was $296,500, according to the American Dental Education Association (ADEA). This high level of debt can jeopardize a new dentist’s ability to choose their

preferred career path.

ASDA Policy

ASDA considers the growing student debt crisis a top priority and advocates for financially sustainable, long-term

solutions.

ASDA's F-4 policy states: The American Student Dental Association supports initiatives to

reduce the burden of debt for dental students. The association urges Congress, state legislatures and state dental

associations to pass measures that include, but are not limited to:

- Reducing student loan interest rates;

- Providing refinancing opportunities to borrowers;

- Providing opportunities for loan forgiveness, scholarships, grants and tax deductibility.

What Has ASDA Done?

Students and dentists have lobbied members of Congress in support of several bills pertaining to student loans at ASDA and the ADA’s annual Lobby Day in Washington, D.C.

- The Resident Education Deferred Interest (REDI) Act: This legislation would allow medical and dental residents to defer their student loans, interest-free, during residency. This measure would save residents a significant amount of money in the long run. ASDA lobbied for this bill at Lobby Day in DC in 2021, 2022, and 2023.

ASDA has signed onto several coalition letters and has been listed as a supporting organization for the REDI Act many times:

June 2021, February 2022, July 2022, March 1, 2023, March 9, 2023