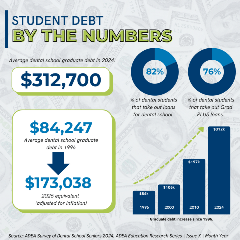

Dental students graduate with an average of $312,000 in student debt. For many new dentists, student debt impacts where they choose to practice and if they want to pursue a residency. ASDA supports initiatives to reduce the burden of dental student debt to give young dentists more autonomy over their career.

Dental students graduate with an average of $312,000 in student debt. For many new dentists, student debt impacts where they choose to practice and if they want to pursue a residency. ASDA supports initiatives to reduce the burden of dental student debt to give young dentists more autonomy over their career.

Recent Changes

In July 2025, the One Big Beautiful Bill was signed into law, which will result in several student loan changes for current and future dental students. Student loans are critical to providing opportunities for prospective students to attend dental school.

Learn More and Access Resources

If you have questions pertaining to the recent changes to student loans, please email

advocacydept@asdanet.org.

In the News

- According to a court filing from a settlement with the American Federation of Teachers, the Department of Education “procedurally denied” over 327,000 requests from borrowers to enroll in a new repayment plan. Read more in the January 2026 Advocacy Brief.

- Student loan forgiveness, excluding Public Service Loan Forgiveness (PSLF), is considered taxable income. Read more in the January 2026 Advocacy Brief.

- In December 2025, the Trump administration cancelled the SAVE repayment plan, announced new rules on student loans, and announced further steps to close the Department of Education (ED). Read more in the December 2025 Advocacy Brief.

- On October 31, the ED issued a new rule stating that employees of organization that have a “substantial illegal purpose” will be ineligible for PSLF. Read more about this and other updates to federal student loans in the November 2025 Advocacy Brief.

- In October, the ED announced it will resume forgiveness for qualifying borrowers in the Income-Based Repayment (IBR) plan. The American Federation of Teachers (AFT) also filed a lawsuit challenging delays in processing student loan forgiveness. Read more in the October 2025 Advocacy Brief.

- On August 18, the ED proposed a rule that would disqualify employers that have a “substantial illegal purpose” from PSLF. Read more in the September 2025 Advocacy Brief.

- On July 29, the ED requested public comments for two new committees to implement changes to student loans from the One Big Beautiful Bill. Read more in the July 2025 Advocacy Brief.

- On July 4, President Trump signed the One Big Beautiful Bill into law, which included sweeping changes to federal student loans. The Supreme Court overruled the decision on July 14. Read more in the July 2025 Advocacy Brief.

- On May 22, a federal judge temporarily blocked the Trump administration’s executive order to close the ED. Read more in the June 2025 Advocacy Brief.

- On March 20, President Trump signed an executive order to take steps to close the ED. Read more in the April 2025 Advocacy Brief.

- Linda McMahon, former CEO of World Wrestling Entertainment (WWE) and Chair of the Center for the American Worker of the America First Policy Institute, was named Secretary of Education in the Trump administration. Read more in the November 2024 Advocacy Brief.