Today’s tax environment can be overwhelming for new professionals. This session simplifies key tax concepts relevant to dental students entering the workforce. Learn how to navigate employee vs. contractor status, understand deductions, manage student loan implications, and explore the basics of setting up your own dental practice—all designed to help you start your career on a strong financial foundation.

Learning Objectives

At the conclusion of this session, participants will be able to:

- Differentiate between working as an employee and as an independent contractor, and explain the tax implications of each.

- Identify key steps, considerations, and common pitfalls when establishing a new dental practice.

- Describe how student loan repayment and interest affect individual tax filings and potential deductions.

- Recognize which expenses qualify as reasonable, ordinary, and necessary business deductions for self-employed dental professionals.

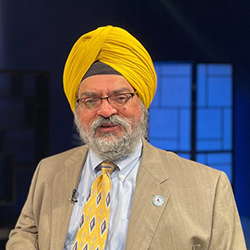

Roger Chawla, CPA

Roger S. Chawla is the owner and CEO of Chawla & Associates, Inc., a Naperville-based accounting firm providing tax, accounting, and advisory services to individuals and businesses for over 30 years. His experience spans professional service industries including technology, healthcare, real estate, and nonprofit organizations.

Roger has led financial audits in accordance with Generally Accepted Accounting Principles (GAAP) and regulatory standards for various industries. He provides clients with tax preparation, planning, and strategic advisory services, often serving in CFO-level capacities to help improve financial efficiency and internal controls.

His healthcare expertise includes financial reporting for medical and dental practices, coordination with external consultants, and advising on cost control and valuation matters. Roger also assists clients with complex tax planning strategies involving international reporting (FBAR), business deductions, education credits, and retirement planning.

In addition to his work with healthcare and dental professionals, Roger also specializes in cryptocurrency compliance and reporting, helping clients navigate evolving IRS guidelines related to digital assets, foreign disclosures, and tax implications of crypto transactions.

A trusted advisor to small and medium-sized businesses, Roger is a member of the Illinois CPA Society, the AICPA, and several national tax associations. He has presented joint seminars with the IRS, law firms, banks, and professional groups on topics such as business startups, payroll tax compliance, and evolving tax legislation.

Through his work, Roger focuses on helping clients navigate an ever-changing tax environment with confidence and long-term financial success.